Irs Schedule Se 2024 – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to .

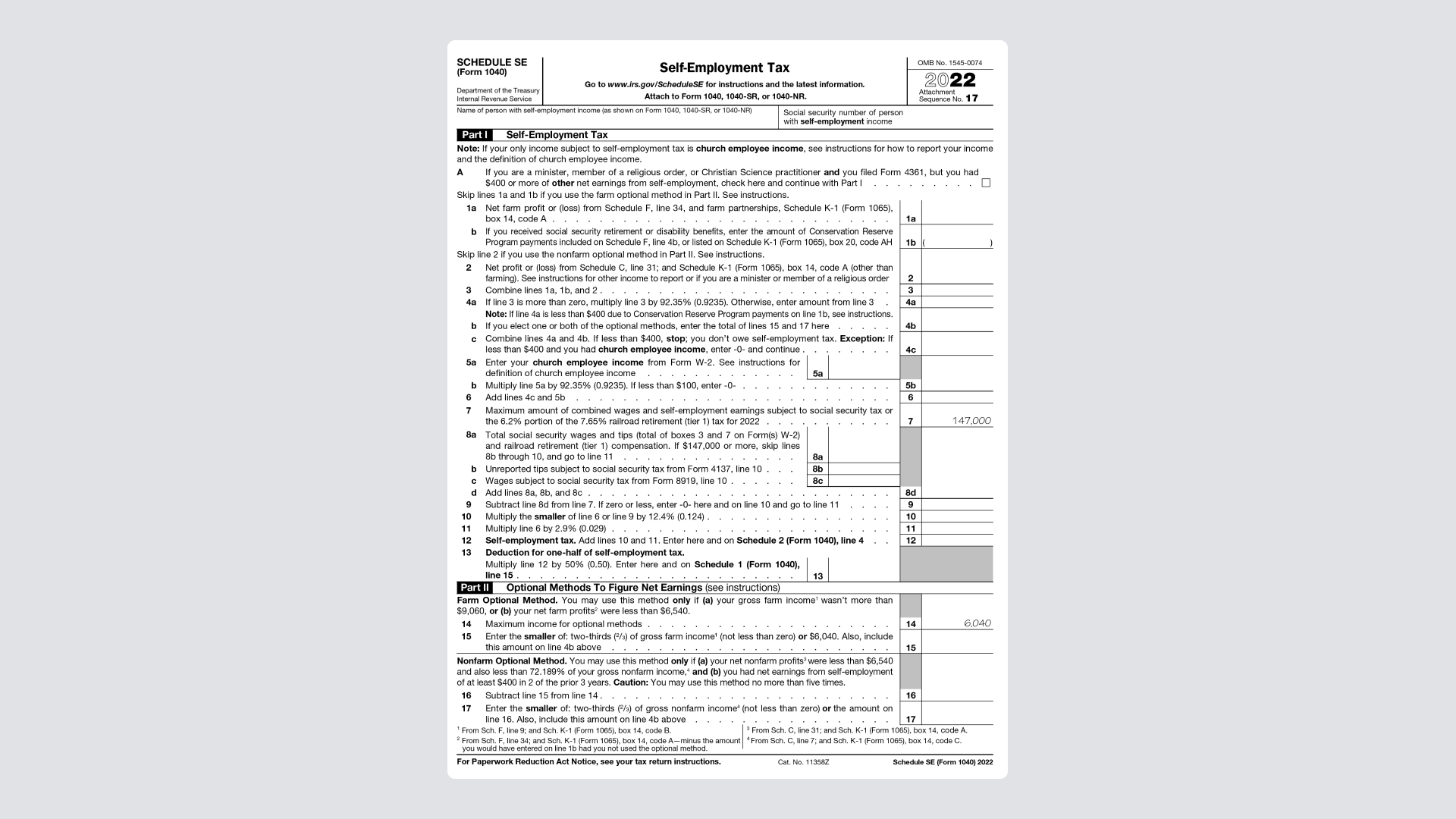

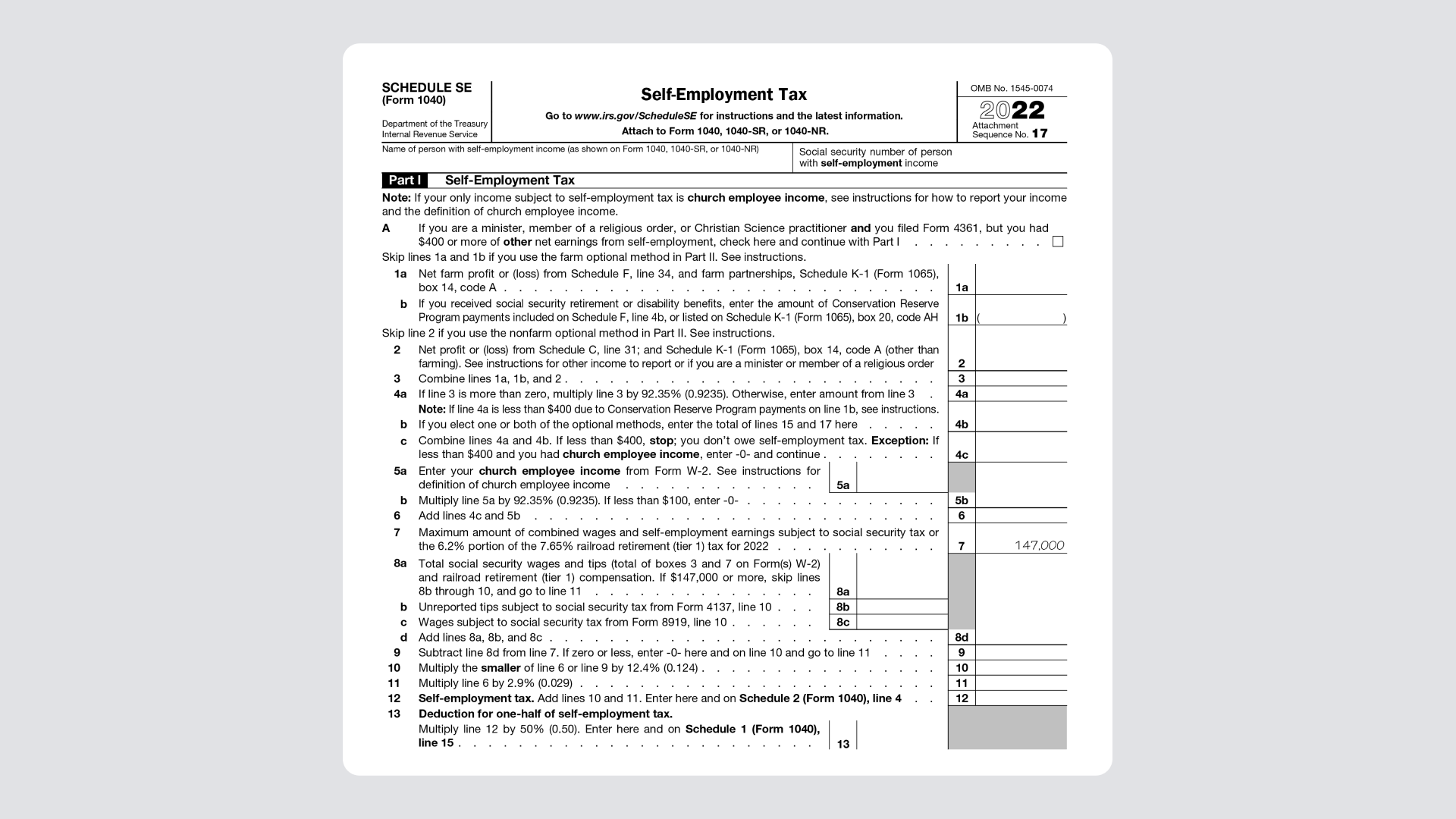

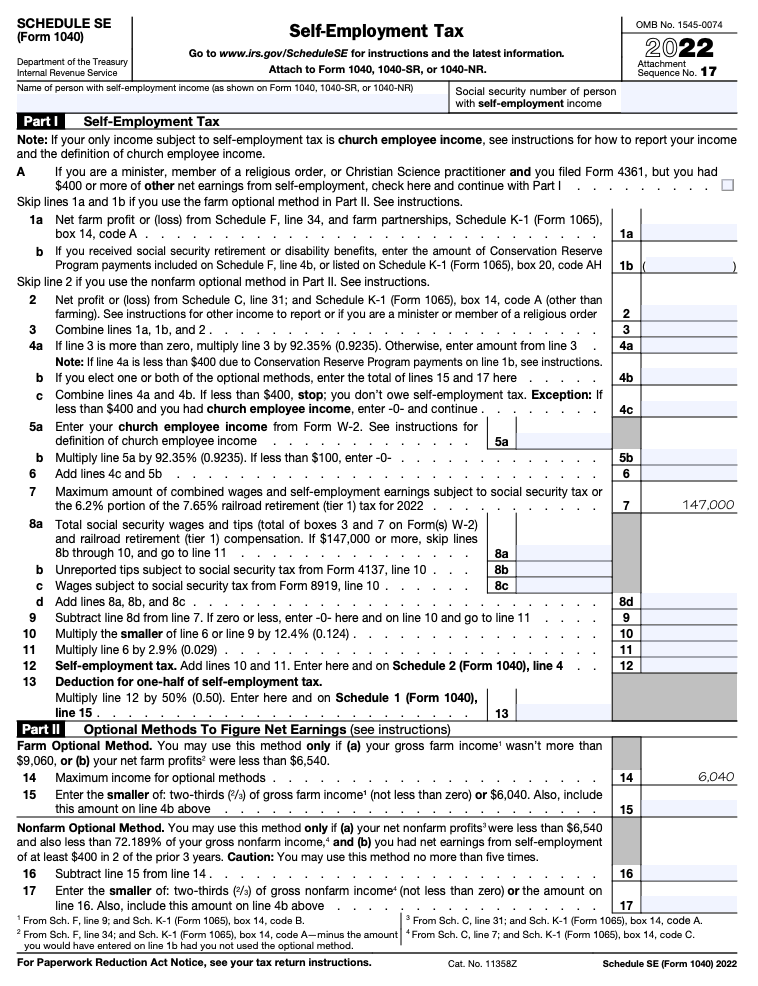

Irs Schedule Se 2024

Source : found.com

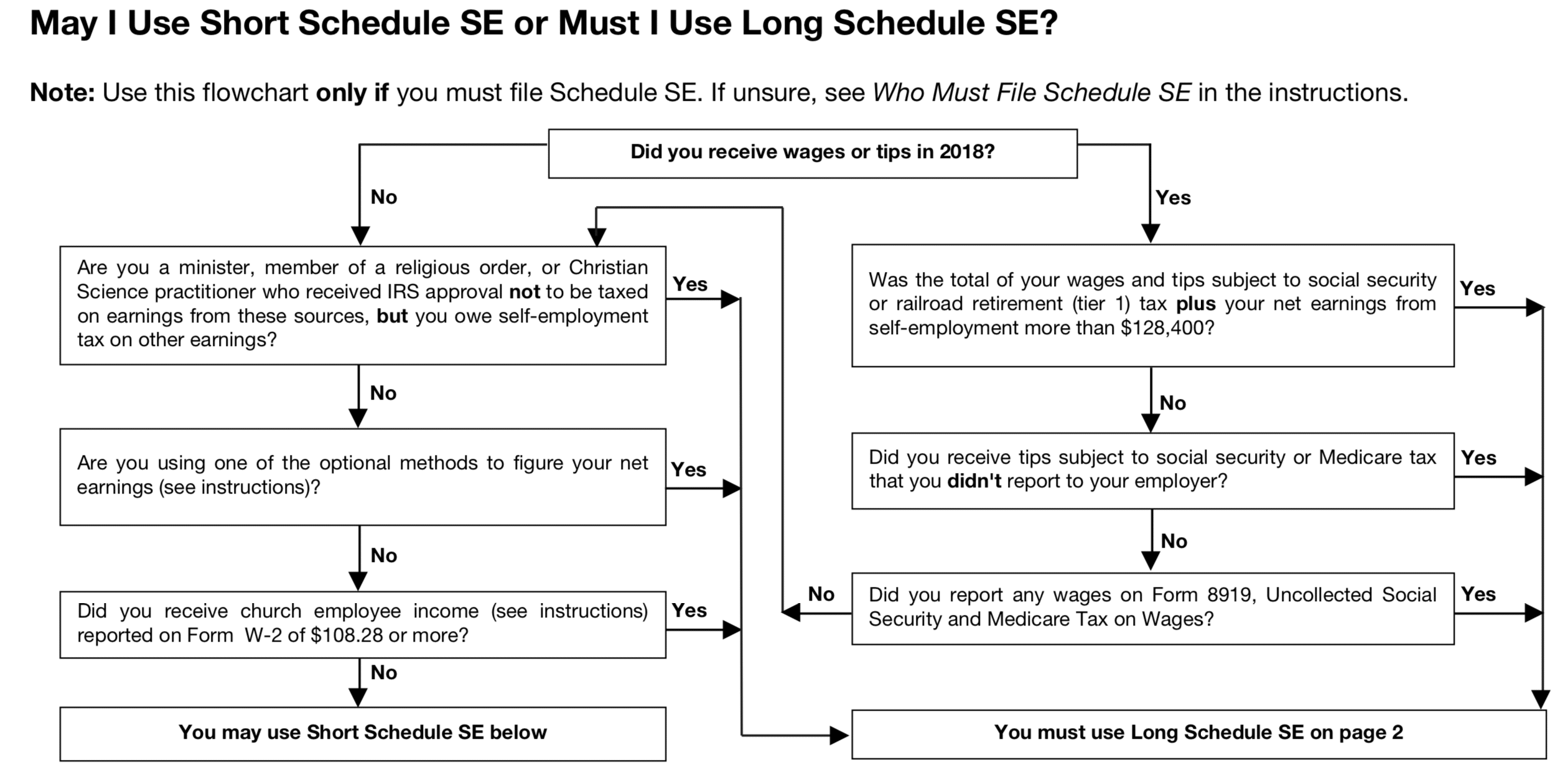

Understanding Self Employment Tax: How to File Schedule SE Tax

Source : www.taxfyle.com

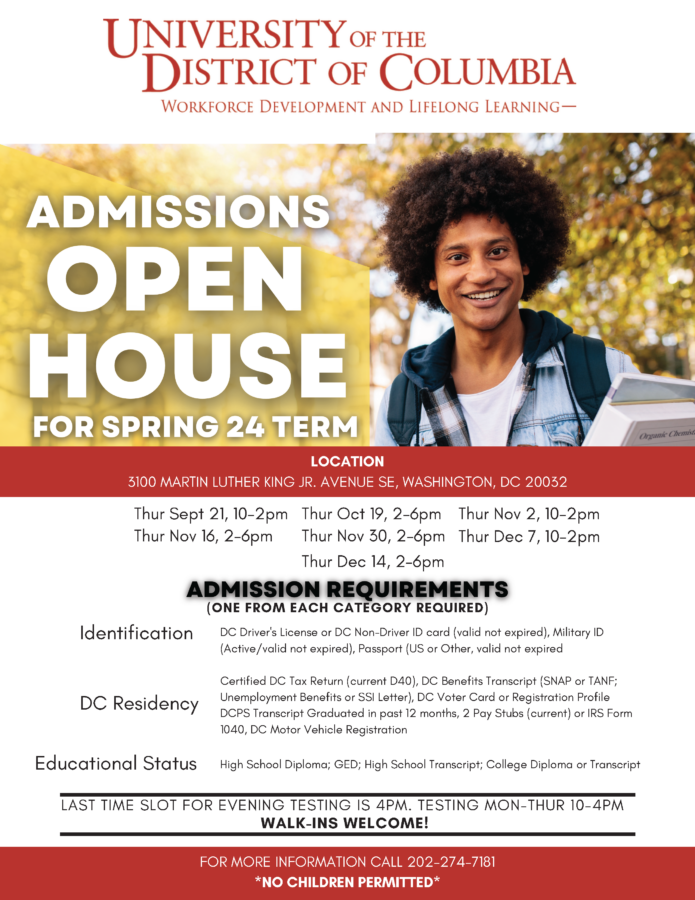

How to Apply and Enroll | University of the District of Columbia

Source : www.udc.edu

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

AJM Associates, Inc. | New Baltimore MI

Source : www.facebook.com

Schedule SE: Filing Instructions for the Self Employment Tax Form

Source : lili.co

Moshe Klein & Associates, Ltd. | Chicago IL

Source : www.facebook.com

What Is Schedule SE? The Tax Form For The Self Employed

Source : thecollegeinvestor.com

Schedule SE: Filing Instructions for the Self Employment Tax Form

Source : lili.co

What Is Schedule SE? The Tax Form For The Self Employed

Source : thecollegeinvestor.com

Irs Schedule Se 2024 A Step by Step Guide to the Schedule SE Tax Form: The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which . In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. .